HMRC Tax Receipts 2024-25 – A quick summary

HMRC’s latest figures reveal a steady but slowing growth in UK tax receipts. Overall revenue reached £858.9 billion in 2024-25, a 3.7% increase compared to the £827.7 billion collected in 2023-24. While the rise reflects continued economic activity and fiscal drag, several areas raise concerns about longer-term sustainability.

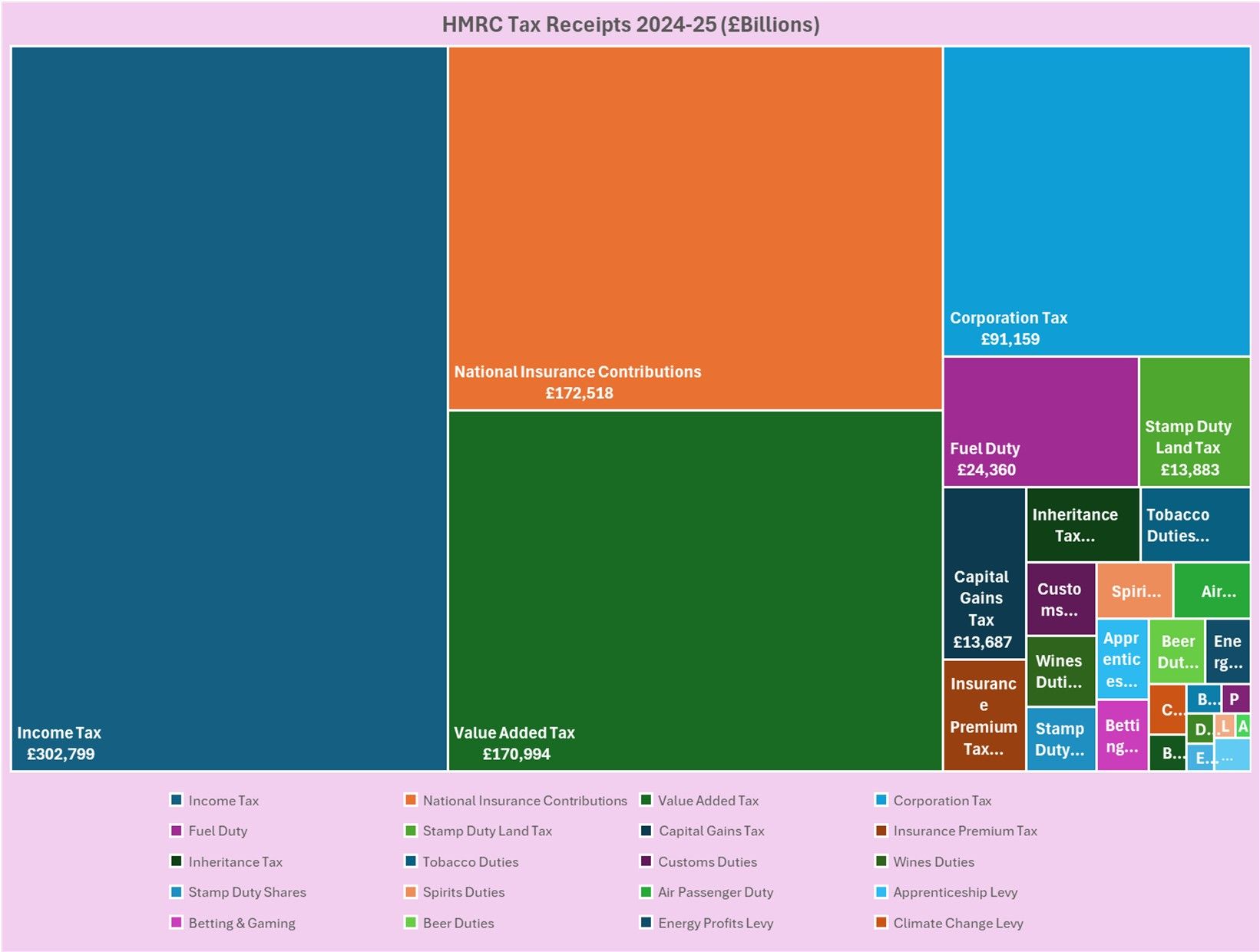

Breakdown of HMRC Tax Receipts – 2024-25

Income Tax and NICs: Growth Despite Rate Cuts

Receipts from Income Tax (£302.8 billion) and National Insurance contributions (£172.5 billion) rose to £475.3 billion from £454.4 billion the year prior. This growth came even as employee NICs were cut from 10% to 8%, showing the strength of wage growth and the impact of frozen thresholds pushing more taxpayers into higher bands. But with take-home pay squeezed, questions remain about how long this momentum can last.

Capital Gains Tax: Declining Despite Sharp Reduction in Annual Exempt Amount

Receipts from Capital Gains Tax has been declining since the high of 2022-23 when £16.9 billion was collected by HMRC through 2023-24 when £14.5 billion was raised, to the current 2024-25 tax year when only £13.7 billion was raised. Whilst many investors and individuals realised gains before the sharp reductions were announced on 2022-23, a cooling property and investment market – driven by higher interest rates, lower housing transaction volumes and more cautious equity markets most likely contributed to a weaker realisation of gains.

Corporation Tax: Record Highs, But Clouds on the Horizon

Corporation Tax receipts increased to £91.2billion from £85.6 billion in 2023-24, cementing the impact of the rate hike to 25%. The Treasury will welcome this boost, but there are growing concerns about whether higher rates could deter investment or drive profits overseas in the medium term.

VAT: Consumer Spending Under Pressure

VAT receipts rose modestly to £171.0 billion from £168.4 billion in the previous year. While this reflects stable consumer spending, the growth rate is slowing compared to previous years as households adjust to inflation and higher interest rates.

Stamp Taxes: A Surprise Rebound

After sharp falls in 2023/24, Stamp Duty receipts (Stamp Duty Land Tax, Stamp Duty on Shares and Annual Tax on Enveloped Dwellings) increased to £18.3 billion. This recovery reflects both higher transaction volumes and the impact of the October 2024 increase in additional property rates. Whether this is a one-off bounce or a sign of stabilisation in the property market remains to be seen.

Fuel Duty: The Long Decline Continues

Fuel Duty receipts fell again to £24.4 billion, down from £24.9 billion last year. Diesel use in particular continues to fall, and the transition to electric vehicles accelerates this long-term decline. Replacing this revenue stream will be a key challenge for future governments.

Inheritance Tax: Quietly Climbing

Inheritance Tax receipts rose again to £8.2 billion, up from £7.5 billion in 2023/24. With thresholds frozen and asset values elevated, more estates are being pulled into scope - raising questions about fairness and the long-term future of IHT policy.

Other Duties: Mixed Signals

- Alcohol Duty receipts were stable at £12.6 billion, reflecting flat consumption patterns.

- Tobacco Duty fell further to £7.9 billion from £8.8 billion, continuing its structural decline. A notable reason for the future introduction of Vape Liquid Tax which is to set to stand at 22p +VAT per ml when it takes effect.

- Air Passenger Duty increased to £4.1 billion from £3.8 billion, reflecting strong post-pandemic travel recovery.

- Environmental taxes remained steady at around

£2.9 billion, with only marginal changes across individual levies.

| Category | Tax Receipts (£Billions) |

|---|---|

| Income Tax | £302,799 |

| NIC | £172,518 |

| VAT | £170,994 |

| Corporation Tax | £91,159 |

| Fuel Duty | £24,360 |

| Stamp Duty Land Tax | £13,883 |

| Capital Gains Tax | £13,687 |

| Insurance Premium Tax | £8,883 |

| Inheritance Tax | £8,249 |

| Tobacco Duties | £7,927 |

| Custom Duties | £4,896 |

| Wine Duties | £4,722 |

| Stamp Duty on Shares | £4,321 |

| Spirits Duties | £4,153 |

| Air Passenger Duty | £4,125 |

| Apprenticeship Levy | £4,100 |

| Betting & Gaming | £3,616 |

| Beer Duties | £3,520 |

| Energy Profits Levy | £2,857 |

| Climate Change Levy | £1,792 |

| Bank Levy | £1,320 |

| Bank Surcharge | £974 |

| Penalties | £826 |

| Digital Services Tax | £808 |

| Electricity Generators Levy | £749 |

| Landfill Tax | £486 |

| Aggregates Levy | £359 |

| Soft Drinks Industry Levy | £327 |

| Plastic Packaging Tax | £253 |

| Cider Duties | £221 |

| Annual Tax on Enveloped Dwellings | £133 |

| Diverted Profits Tax | £105 |

| Residential Property Developers Tax | £102 |

| Economic Crime Levy | £16 |

| Petroleum Revenue Tax | -£350 |

Conclusion

The 2024/25 data paints a picture of resilience, but also fragility. Total tax collections at £858.9 billion confirm that the UK continues to operate under one of the highest tax burdens in decades. Yet underlying trends - slowing VAT growth, falling fuel duty, and reliance on frozen thresholds - signal challenges ahead.

Unless addressed, questions of sustainability, fairness, and competitiveness will continue to loom large over the UK’s tax system.

Friend Partnership is a forward-thinking firm of Chartered Accountants, Business Advisers, Corporate Finance and Tax Specialists, based In The UK

Share this page: